Hacking into your life

Advancing technology increases the need for indentity theft precautions

December 14, 2017

Photo by Alyssa Kift

Photo by Alyssa Kift

Name. Date of Birth. Address. Age. Gender. Ethnicity. Social Security Number. Fingerprint. Insurance Numbers. Bank account information. These attributes make up our identities. We are classified by these qualifications, and they make each individual distinct from the next person. But what happens when the very components that make up who you are are taken away?

In today’s age of rapidly advancing technology, the world of crime is concurrently becoming more progressive, making it more difficult for civilians to avoid victimization. These faceless offenders single-handedly have the ability to deprive the innocent of everything they own– most significantly their identity.

Many people have misconceptions regarding the typical ways in which a thief acquires their private information. Many think that a criminal has to physically have a credit card or the victim’s information in his hand. Others believe that filling out online scams or practically giving away their information are the only way to steal someone’s identity. However, the potential to compromise security is present in all of these situations and more.

“When you are talking about identity theft, you are talking about something that you are not even aware of a lot of the time until you know several months down the road,” said Shawn Vaughn, Public Information Officer for the Texarkana, Texas Police Department. “It’s not unusual for somebody to come and dumpster dive from the trash that you leave out on the curve and pull out credit card offers that you’ve gotten or go through your mailbox before you have the opportunity to check it. Quite honestly, most of the time it’s just somebody that has come across your information.”

Using the same technology that is found in debit card chip scanners, felons have created skimmers that they hide inside card readers at places such as gas stations. They can be so small that they are completely unseen or undetectable.

“We were posting several weeks ago on our social media about skimmers, where you swipe your credit card at the gas pump or the Redbox or something similar to that,” Vaughn said. “If there’s a skimmer, the culprits are actually collecting your information from your credit card.”

At these stations, you would theoretically drive up to a pump and insert your card. If a skimmer had been placed there, the card would most likely be declined, so you would think the pump was malfunctioning and simply move to the next pump. However, a criminal nearby could possibly be watching and waiting until a few people have swiped their cards, yet it was actually copying their information.

“We’ve not had any skimmers that we have located or found locally here because, traditionally, they’ve only been on the machines for 15 to 20 minutes,” Vaughn said. “They’re not left for a long period of time and usually the thief is nearby anyway, so if a cop pulls up, the thief would probably find a way to pull it out before anybody knew anything about it.”

Also, some skimmers have become able to use Bluetooth so that someone could be across the parking lot and electronically retrieve the card information. In this case anyone could be a victim.

“They say that if you check your Bluetooth on your phone and you tell it to connect or look for discoverable items and you come up with one that is just a long series of numbers and letters that makes no sense, then there is a possibility that there may be a skimmer in use somewhere in range,” Vaughn said. “We aren’t sure how accurate the Bluetooth trick is because all it is going to do is say that there is a possibility of something being there. You may want to think twice about using Bluetooth. Also, physically pull on the machine to see if it’s loose.”

In addition to skimmers, there are cases of restaurant employees taking someone’s card and copying or taking a picture of the information when they’re supposed to be using it to pay the bill. The only way to monitor this is to check your statements every month.

“If you’re at a restaurant and you hand your card off to the waitress and she walks back there, she doesn’t even have to have a skimmer,” said Christian Pool, Director of Risk Management at Red River Credit Union. “She can take a picture of your card on her phone and have your card information. It really does happen. You have to be safe with the information on your card.”

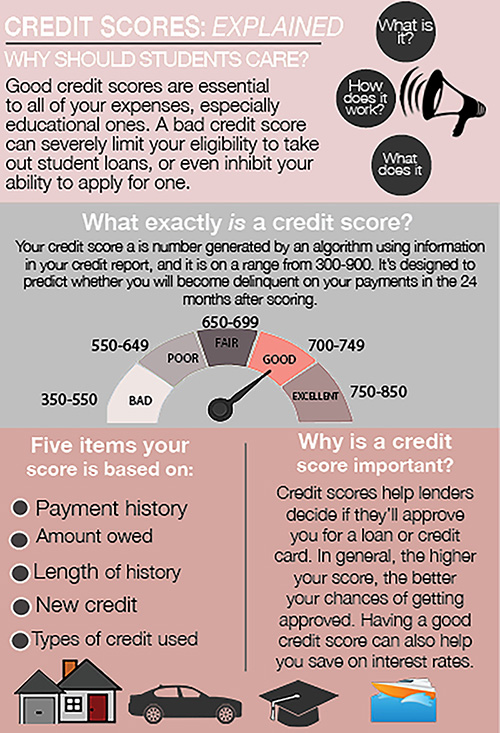

When you are protecting your identity, the most time-consuming yet necessary process is the constant attention to the charges on your cards. If you notice a purchase that is unfamiliar or strange, you should notify your bank as soon as possible.

“It’s kind of unfair because there’s a time limit after you know that your credit card information has been stolen,” Vaughn said. “If you notify the bank within two days, then your liability is limited to $50. If you don’t and wait just five days, your liability jumps up to $500. After 60 days you are completely on the hook for whatever the charge was. Don’t be afraid to challenge any statements you don’t recognize or don’t remember making.”

Because there is a limited amount of physical evidence available from the crimes, the police must rely on bank records tracking the purchases made on the stolen card and surveillance video.

“We have a lot of what we call frequent flyers,” Vaughn said. “We spend 80 percent of our time dealing with 20 percent of the population. Because of this, a lot of times, if the detective has a case, they can send the picture out over an email to their colleagues who many times can identify them. If that doesn’t work, they will send the picture to me, and I’ll send it out on social media. A lot of times, civilians will identify the suspect out of a sense of civic responsibility or because Crime Stoppers will pay them up to $1,000.”

Due to the competition and increased police attention, thieves have begun targeting certain groups, especially the elderly and teenagers.

“On the internet, there are drawings that you can fill out,” Pool said. “The drawings usually ask for your email or you might get an email from Walmart or some other store that says you’ve won a $100 gift card and they ask you to fill out some information. These identity thieves are smart and it can look exactly like an email from Walmart, and that’s a way that they can steal your identity.”

Some may say that online forms are an obvious scam, but little do they know that thieves lurk behind many trusted internet websites.

“Always make sure the lock is in the browser and make sure you’re on a secure website,” Pool said. “[Identity thieves] are very smart, especially with computer technology. There are some websites that even may have that lock there. It’s gotten so bad that the thieves know how to make the locks look identical, and make sure that everything has the disclosures that say that the website you are on is safe and secure. You may want to call the phone number on the website if it makes you that nervous.”

If you notice that your debit or credit card has been compromised because a small amount of money is taken, it often just takes a quick trip to the bank to get a new card.

“In some cases, we will encourage you to close your account and get a new one,” Pool said. “We can stop that card and get you a new one, and it won’t affect your account. When [identity thieves] take that debit card information, they’re not taking your account number, so we don’t necessarily have to close your account out. You can still have your account number and just get a new card.”

For someone to get his or her identity back or to mend the effects of a long-lost stolen credit card, the process if often long and arduous.

“When you realize that your identity or credit card have been compromised, you need to go to the police department and report it,” Pool said. “We will advise you to report it to one of the three credit bureaus. If you notify one, it notifies all three, and you can put a restriction on your credit. That way, when a merchant or a lender pulls up your Social Security number, they will have an alert on there that you’re a victim of identity theft.”

The best tip is to be vigilant in protecting your information and when using debit or credit cards.

“I’ve actually come to the conclusion that if somebody wants to do something bad enough they’re going to figure out a way to do it,” Vaughn said. “You just [have to] try to be on guard as much as you possibly can to avoid being that person that they victimize.”